Blog

News and Insights

Stay ahead with expert insights on technology, artificial intelligence (AI), and financial world. Our blog covers the latest trends in fintech, AI-powered financial tools, digital transformation, and data-driven decision-making to help professionals, investors, and tech enthusiasts navigate the future of finance.

Understand how non-business transactions signal cash discipline, governance quality, and financial risk in company health analysis.

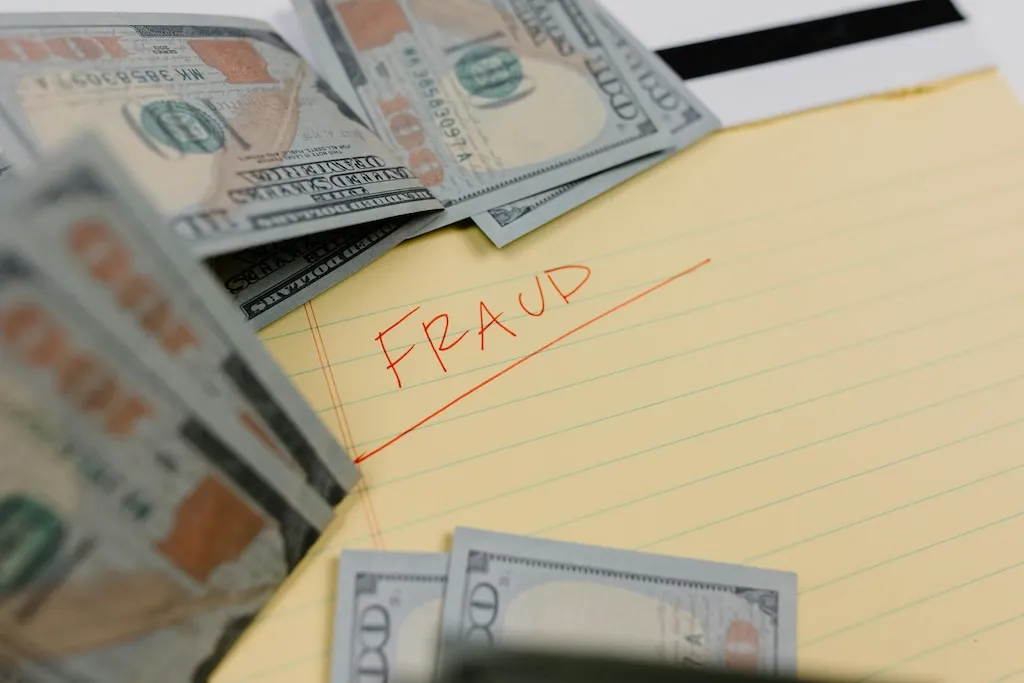

Explore how fraud analysis is shifting from reactive detection to preventive, data-driven monitoring systems in modern financial environments.

Learn how to detect window dressing early by analyzing patterns, cash flow mismatches, and transaction anomalies before business risks escalate.

In many organizations, fraud analysis systems only kick into gear after losses have already occurred. This evolution moves from mere detection towards prevention embedded within business processes.

Learn how window dressing distorts decisions, weakens governance, and erodes business trust over time.

Digital transformation in the financial sector does not rely solely on new systems or modern applications. In fact, its biggest challenge often lies in data that remains trapped in physical or unstructured formats.

In the credit analysis process, credit bureau reports serve as a primary source for understanding the risk profile of a financing applicant. Information such as payment history, active obligations, and credit utilization patterns is used by creditors to assess funding eligibility.

Transparency and independence are the main foundations of the peer-to-peer (P2P) lending ecosystem. Lender trust in the fund distribution process heavily relies on the belief that funding decisions are made objectively and free from conflicts of interest.

Peer-to-peer (P2P) lending platforms operate in an environment that demands speed, accuracy, and consistency. Every day, operational teams handle large volumes of data—from borrower documents and transaction information to verification and monitoring processes.

In financial statement analysis, numbers never stand alone. Behind every report lies management decisions regarding recording timing, account classification, and information presentation. One practice often discussed in financial literature is window dressing.

In financial statement analysis, irregularities do not always appear in the form of extreme numbers. Often, early signals are visible in the type of transactions recorded.

Learn common suspicious transaction patterns, early fraud indicators, and why transaction monitoring is critical for effective fraud analysis.

Discover how OCR improves accuracy, speed, and document traceability to support smarter data management across industries.

A data-driven look into why fintech lending platforms collapse, the common patterns behind mass defaults, and how robust verification processes strengthen risk governance.

Learn what OCR is, how it works, its advantages for businesses, and examples of its applications in banking, fintech, logistics, and government sectors.