Machine Learning for Anomaly Detection: An Effective Solution for Fraud Detection

The increasing complexity of data flows in the digital world has made the need for robust and secure systems more critical than ever across various industries. With millions of data points generated every second, undetected gaps can become entry points for fraud or systemic losses.

This is where a smart approach to identifying deviations from normal patterns becomes essential. This approach is known as anomaly detection.

Understanding Anomaly Detection and Its Importance for Modern Systems

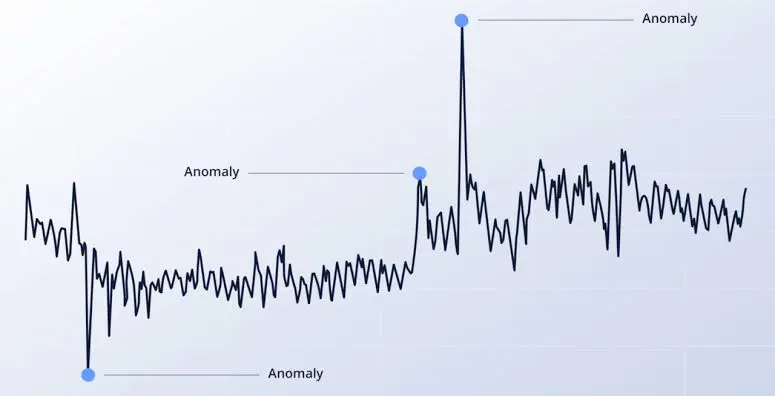

Anomaly detection is a data analysis technique used to identify patterns that deviate from general trends. In practice, this method is often employed to detect fraud, system errors, cyberattacks, or unexpected performance issues. Such detection serves as the foundation for reliable security systems, financial monitoring, and network surveillance.

The anomaly detection process leverages machine learning to recognize historical data patterns and automatically detect abnormal deviations. This technology not only speeds up problem identification but also reduces reliance on manual systems, which are prone to bias and delays.

The Role of Machine Learning in Anomaly Detection

Machine learning-based approaches enable systems to learn from historical data without requiring explicit programming for every type of anomaly. Models such as Autoencoders, Isolation Forest, Support Vector Machines (SVM), and others have proven effective in identifying anomalies in both structured and unstructured data.

These models do not merely classify data as normal or abnormal—they can also detect subtle irregularities at a micro level that might escape human scrutiny. It is this accuracy and scalability that make machine learning a superior solution, especially in large-scale systems with real-time data streams.

Types and Applications of Anomaly Detection

According to Mane et al. (2022) in an academic journal, anomalies can be classified into three main types: point anomalies, contextual anomalies, and collective anomalies, each representing different forms of deviations in data.

A point anomaly occurs when a single data point deviates significantly from the rest of the dataset. In contrast, a contextual anomaly arises due to specific time-based or conditional contexts. As the name suggests, a collective anomaly refers to a group of data points that, when considered together, exhibit abnormal behavior.

This technology finds applications across various industries. In the financial sector, anomaly detection helps identify suspicious transactions. In healthcare, it can detect irregularities in patient data. Meanwhile, in IT and infrastructure, it enables real-time monitoring of network stability and server load.

Towards an Adaptive and Secure System

The integration of anomaly detection with machine learning fosters an adaptive and resilient ecosystem capable of withstanding disruptions. Continuously learning algorithms refine predictive models over time, enhancing their precision in identifying potential threats or system failures.

The implementation of this technology not only enhances monitoring efficiency but also strengthens the foundation of trust in digital systems. Security, stability, and data-driven decision-making become more accurate and long-term oriented.

References

Related Articles

The success of a modern business is not only determined by marketing and product innovation, but also by the ability to comprehensively understand its financial condition. Financial statements do present data, but without proper analysis, this information is difficult to process into a foundation for decision-making.

A National Seminar, “Resilience and Turnaround: Indonesia's Economic Direction”, hosted by The Indonesian Financing Companies Association (APPI) held at the Pullman Hotel Thamrin, Jakarta.

Every banking transaction contains crucial traces that reflect an entity's financial activities. For auditors, these traces become essential material for verifying the accuracy of financial reports. However, when transaction data continues to grow in high volumes, manual methods of examining bank statements are no longer relevant. This is where bank statement parsing emerges as a modern solution that addresses digital audit challenges.