What Is Bank Statement Parsing? Understanding the Basics and Its Benefits

The Basics of Bank Statement Parsing

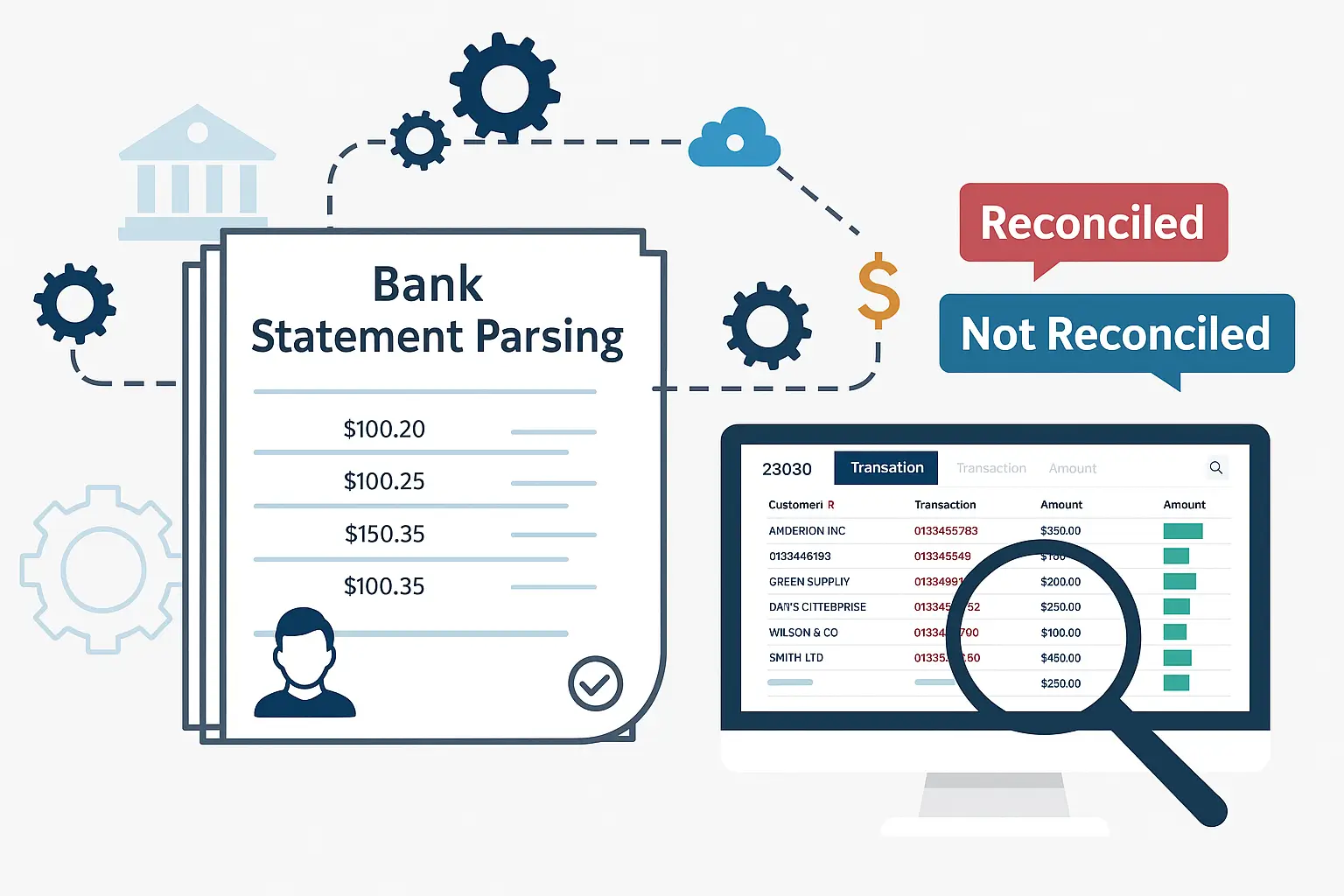

Bank statement parsing is the process of converting transaction data from banking systems into structured and easily understandable information. Statements, which are typically displayed as long, unorganized text, are broken down into key components such as date, amount, transaction type, sender or recipient, and payment details.

This process can be performed automatically through system integration or by using exported files from internet banking. Parsing technology reads raw data, identifies essential elements, and then organizes them into a neat table or dashboard format. Thanks to parsing results, financial management can be carried out in a more structured and precise manner, eliminating the need for manual record-keeping.

Simple Illustration of the Parsing Process

Imagine a business that receives numerous transactions daily and needs to match them with invoices. With bank statement parsing, the system can automatically extract transaction data, identify the sender, the transferred amount, and the purpose of the transaction. This information is then instantly matched with internal records, enabling payments to be verified without human intervention.

Benefits of Bank Statement Parsing

Operational Efficiency with High Accuracy

Time savings is one of the key advantages of bank statement parsing. The system can read, classify, and organize transaction data directly without the need for manual data entry.

Parsing also reduces the potential for human input errors, such as mistyped amounts, missed transactions, or misclassification. This accuracy plays a crucial role in maintaining the integrity of financial reports and preventing balance discrepancies that can disrupt cash flow.

Automated Reconciliation and Financial System Integration

Reconciliation is the process of verifying bank transaction data against a company's internal financial records. Bank statement parsing enables automated reconciliation using predefined logic rules, such as matching sender names, transaction amounts, and reference numbers.

Bank statement parsing can be seamlessly integrated with ERP systems, accounting software, or invoicing applications. This integration allows bank-sourced data to automatically populate corresponding fields or forms within internal systems. As a result, it establishes a unified financial ecosystem, streamlining processes from customer payments and revenue tracking to tax reporting.

Document Authenticity Verification and Change Detection

This process enables the system to analyze the digital structure of bank statement files and verify their authenticity. As a result, users can determine whether a document is an original file or has been tampered with.

If manipulation is detected, the system flags modified entries for further review. This capability is critical for financial forensic investigations and rapid validation in financing services, ensuring data integrity and trust in financial records.

Cash Flow Analysis & Automated Credit Assessment Support

Parsed transaction data enables comprehensive cash flow analysis - tracking account holders' income streams, expenditures, and idle balances. This analysis serves as an objective foundation for banks, multi-finance companies, and P2P lending platforms to evaluate potential borrowers' financial viability.

Credit scoring can be conducted more quickly and accurately through parsing, as transaction data is presented in a structured and analysis-ready format. This supports a more efficient and data-driven credit approval process.

Digital Age Relevance

Bank statement parsing has become increasingly critical amid the exponential growth of digital transactions. In business management, accurate financial information forms the cornerstone of strategic decision-making.

Bank statement parsing is no longer just an option—it's a necessity for individuals and businesses seeking to manage financial transactions more swiftly, intelligently, and professionally. With an automated system, financial recording and monitoring become more efficient and free from the risk of human error. As a result, partner trust and customer satisfaction can also increase.

References

Related Articles

Simplifa.AI and BPRS HIK Parahyangan formally inked a strategic collaboration agreement in Bandung on September 25, 2024, which was a significant turning point in the adoption of AI technology in the Islamic banking industry

Learn what document parsing is, how it works, the supporting technologies, and its benefits for digital businesses efficiently and accurately.

Thoroughness in preparing financial reports is a fundamental foundation for business sustainability. These documents do not only function as reporting tools, but also as a means to assess performance and determine the direction of strategic decision-making.